Office Hours

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health

Other Products

Banking

Would you like to create a personalized quote?

Loren Valdez

Office Hours

Address

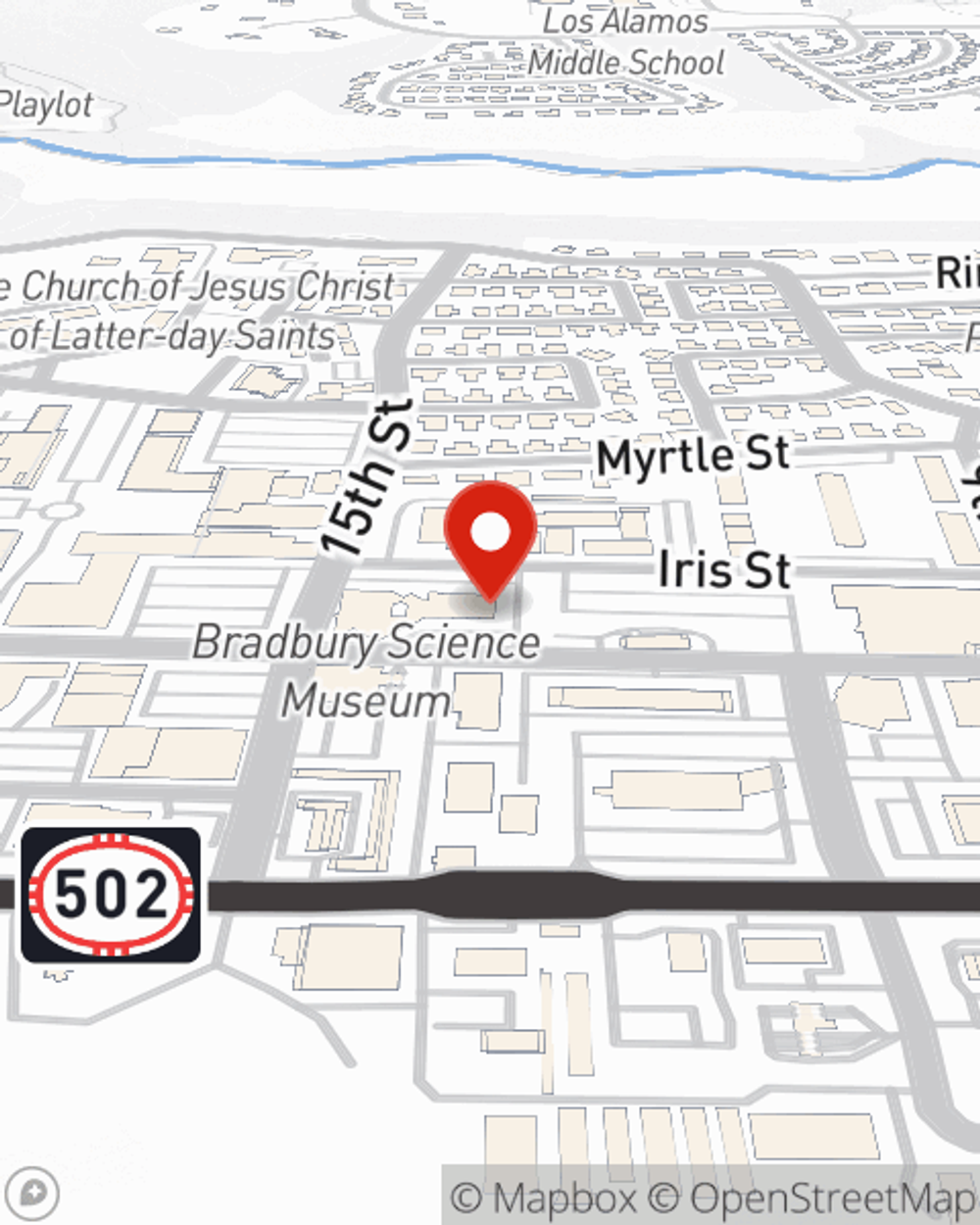

Los Alamos, NM 87544-3218

Attached to the Bradbury Science Museum

Office Hours

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health

Other Products

Banking

Would you like to create a personalized quote?

Office Info

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health

Other Products

Banking

Office Info

Simple Insights®

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

National Animal Poison Prevention Week: What you need to know

National Animal Poison Prevention Week: What you need to know

Poison Prevention Week isn’t just about humans. Protect dogs and cats at home with these simple tips for identifying and preventing toxic ingestion in pets.

Car insurance for college students

Car insurance for college students

When going away to college, there may be options to help lower your auto insurance premiums depending on your situation.

Viewing team member 1 of 2

Greg Valdez

License #20066891

Greg has returned to his home state of New Mexico after living in Burbank, California, Chicago, Illinois and Belo Horizonte, Brazil, where he studied and pursued his passion for music. Greg’s welcoming and easygoing personality has allowed him to excel in his new customer acquisition role. Greg enjoys traveling but is always eager to get back home to New Mexico where he loves spending time with family and friends.

Viewing team member 2 of 2

Tiffany Van Newkirk

License #16231560